Loan management software

Manage the servicing of financial products quickly, automatically and cost-effectively

Speak to a member of the team to find out more about Aryza Lend

Loan servicing software to automate the full loan cycle, from communications and document management to partnership management and operational support

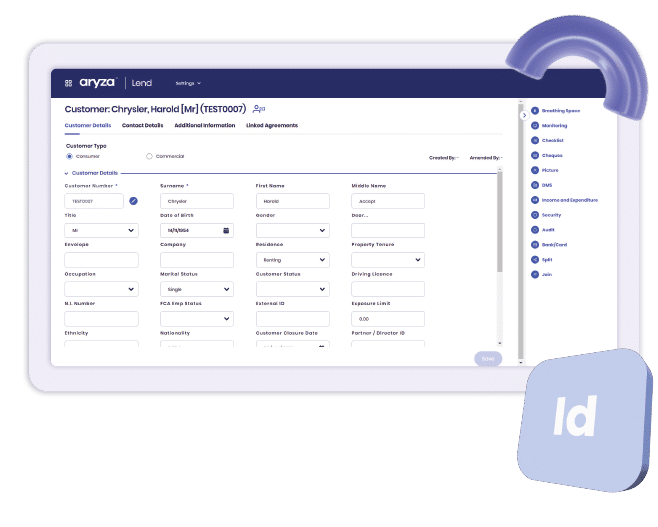

Aryza Lend is a secure, cloud-hosted lending platform which automates the entire lending cycle. Save time, money, and manage your loan services in a way which is easy to keep on top of.

Our loan servicing software is quick to implement and delivers seamless integration with existing systems.

From application to collection, this is an all-in-one secure loan servicing software solution for mortgage providers, credit card providers, vehicle finance providers and other lenders.

Aryza Lend has a unique modular design that can be deployed at the relevant point of a customer’s journey. Used by start ups and established businesses, it is tailored to meet your requirements.

Aryza Lend is simple to use loan management platform that will deliver significant benefits and cost savings to your lending business

Improve end to end loan management processes

Fully digital automated origination

Reduces costs

Regulatory compliance

Processed quicker

Easy application

Self-service

Agreement management

Arrears handling

User definable workflows

Streamlined corporate credit monitoring

Automated on-boarding and credit management

Comprehensive financial product management

Find out more about Aryza Lend, download our brochure now

Aryza lending solutions

Aryza has a rich heritage of working with lenders and brokers to deliver award winning automation for all aspects of loan servicing.

£7Bn

of live lending managed by Aryza systems

196

lending brands currently supported by Aryza systems

c£120M

payments processed each month by Aryza systems

FAQ

Create and manage loan portfolios

Centralised document management

Compliance management

Automated underwriting

Customer management

Billing and invoicing

Audit trails

Commercial lenders

Mortgage providers

Credit card providers

Vehicle finance providers

Other lenders

Improved backend processes, optimum operational efficiency, smoother experience, Reduction in costs, greater insights, regulatory compliance

Fast, accurate and efficient, approval of loans at speed while maintaining regulatory compliance

Digital, easily navigable customer journey, cost effective

Aryza Lend is a modular loan and lease management platform providing over 200 lending businesses with a flexible SaaS based solution. The loan management software is made up of several core modules which can take end customers from an initial application, through the underwriting process onto agreement execution to instalment collections, arrears management and settlement.

Aryza Lend can be used for both consumer and business finance, the flexible nature of the loan management software means that it is tailored to each business’s needs.

Contact us

"*" indicates required fields