Effective risk management for factoring companies

Detect fraud early and fight it effectively thanks to automated customer verification with software from Aryza

As a factoring company, you know that fraud prevention is critical to maintaining the integrity of your business operations. Fraud can not only cause significant financial losses, but can also negatively impact your company’s reputation. Therefore, it is essential that you have advanced solutions that detect fraud early.

Using Open Banking and credit agency data, our innovative software solution gives you the tools you need to proactively identify and prevent many fraud scenarios. We understand the specific requirements of factoring companies and have developed our solution to give you a decisive advantage in this highly competitive market.

With our software for factoring companies you can:

Automatically detect cases of fraud and react to them at an early stage.

Implement integrated review and decision-making processes.

Conduct comprehensive portfolio analyses.

Meet compliance requirements and automate KYC processes.

Make quick and confident decisions based on relevant data.

Enable easy integration with external service providers and credit bureaus.

Simple monitoring of your corporate customers

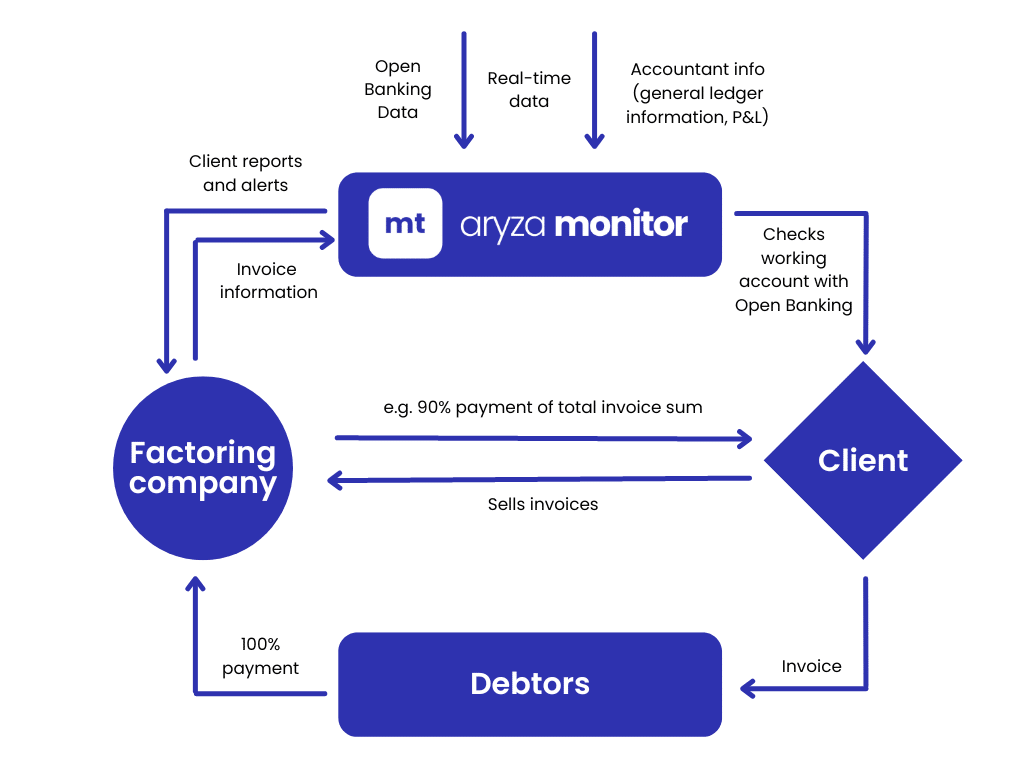

Using Open Banking and Open Ledger technologies, via one single API integration, Aryza Monitor helps factoring companies by providing key company information, automating the collection of key accounting data such as creditor and book debt ledgers, and providing a powerful analysis of a company’s banking transactions.

Take your factoring business to the next level and perfect your risk management.

In today’s fast-paced business environment, manual processes can barely keep up with the increasing demand for factoring services and regulatory requirements.

Our comprehensive software for factoring companies is a stand-alone, or fully integratable if desired, solution that not only meets regulatory requirements, but also paves the way for growth and success through process automation.

Want to learn more about the benefits our solutions bring to factoring companies? Speak to us today

Our solution offers you these advantages:

Effortless fraud detection and risk assessment

Our state-of-the-art software automatically detects potential fraud and allows you to quickly assess the risk. By using open banking data, we offer comprehensive risk assessments so that all relevant information is always at your fingertips. Integration with numerous credit agencies and external data sources ensures comprehensive risk analysis.

Informative reports and portfolio analysis

Make informed decisions and manage your factoring portfolio effectively with our powerful reporting and analysis tools. Our software offers comprehensive data visualisation and standard reports, as well as customisable analysis options.

Compliance made easy

Simplify your KYC, compliance and fraud prevention processes with our intelligent software. Automate customer identification, verification and verification while ensuring regulatory compliance. By using the right data, you can set rules and algorithms to detect and prevent fraudulent activity, secure your business and improve security.

Seamless integration with external partners

Gain access to a wide network of information providers and other external service providers through our API interface. Our software integrates seamlessly and allows you to efficiently use data from numerous sources. This ensures cost efficiency and flexibility in selecting the most relevant data for your factoring decisions.

Experience the next generation of factoring solutions

Join the ranks of forward-thinking factoring companies and experience the transformative power of our Open Banking-based software. Improve fraud detection, streamline processes and drive business growth using our software for factoring companies.

Our goal is to give you the tools to detect fraud early, optimise your processes and grow your factoring business safely and successfully. Rely on our innovative software solution and be one step ahead in fraud prevention.

Discover the benefits of our software for factoring companies and contact us today for more information or to request a demo. Get the protection and confidence you need to successfully protect your business from fraud.