Issue 1: Risk Management

The top 7 risk factors for 2023

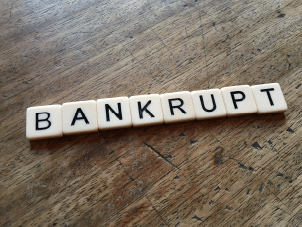

Insolvency risks

Inflation, Ukraine war, supply chain problems – how bad will it be in 2023? Here, we take a closer look at the various risk factors and highlight which sectors will be particularly affected.

Risk factor 1: Zombie Companies

According to Christiane von Berg, Chief Economist for Northern Europe & Belgium at Coface, an end to zombification is not in sight for the time being. The problem remains that market forces have been suspended for three years now. Government pandemic aid did not end until June 2022, and has transitioned virtually seamlessly into support measures in the context of the energy crisis. “While these measures are on a smaller scale, it still leaves it unclear which company is a coma patient and can be revived and which company has ultimately mutated into a zombie,” says Christiane von Berg.

Philip Boland, Product Owner Credit Management at Aryza, also believes: “Two years of curtailing operations, but extra debt, e.g., through COVID grants, has a natural impact.” However, compared to the other risk factors, he believes the risk of zombification is rather low. Allianz economists predict a 10% increase in global corporate bankruptcies for 2022 and 19% for 2023. Anna-Katharina Wichmann, Regional Commercial Director of Allianz Trade in the DACH region, speaks of a “gradual normalization of insolvency activity following the massive fiscal support for the economy in recent years.”

Considerations

Risk of insolvency: no specific industries, now also larger companies.

Solution approaches: Monitoring, insolvency checks, employee training, constantly updating scorecards.

Risk factor 2: Expensive energy and raw materials

Few topics have kept businesses and private citizens on their toes like the issue of rising energy prices, which has been a major driver of inflation in many countries.

Philip Boland sees expensive energy and expensive gas, without our being able to intervene effectively, as the greatest danger to our society. The rule of law and security come into conflict here, he says, when citizens can no longer cook themselves a meal or keep their homes warm. In the view of the credit management expert, a price cap discussed by Europe is not the solution, but would only lead to more uncertainty and possibly even to insolvencies among privatized energy suppliers.

Albrecht Vater, BARDO international federation of the credit insurance brokers, thinks: “Already in 2021, the prices of important raw materials had doubled, from which the automotive and steel industries had suffered in particular. “Since 2022, energy prices have now been driving Europe into recession. We are already seeing a risk of non-payment that has risen, in some cases by leaps and bounds, which will at least be alleviated somewhat by the planned energy price brake,” Vater says . On the supplier side, however, this is only small consolation, he says , because even now they do not always receive, or do not always immediately receive, sufficient credit limits to cover the risk of non-payment. “More and more companies are therefore asking us credit insurance brokers for additional coverage.”

Considerations

Risk of insolvency B2B: energy suppliers, energy-intensive companies chemical, food, paper industry

Insolvency risk B2C: financially weak consumers

Solution approaches: Automated receivables management with simultaneous individual communication.

Risk factor 3: Supply chain problems

Supply chain problems, during the Corona crisis at Chinese ports or triggered by the Ukraine war, have recently affected many industries. Some have been hit particularly hard: “Automotive suppliers in crisis” was a headline of Transport-online.de, a newspaper for freight transport. This was also reflected recently in an increase in insolvencies.

“Since the start of the pandemic, global supply chains have been under high pressure – also due to China’s long-standing zero-covid strategy,” says Albrecht Vater, BARDO International Association of Credit Insurance Brokers. “The just-in-time principle of many industries faltered, even partially came to a standstill. Companies had to incur additional expenses for replacement purchases of individual components, and penalties were incurred for non-delivery of products or significantly delayed delivery of equipment in the mechanical engineering sector. All this will leave its mark on future company balance sheets and increase the risk of bad debts. As an alternative to just-in-time, some companies are now increasing their storage capacities – tying up capital – and providing liquidity with factoring. This trend will continue to grow in 2023.”

Considerations

Industries particularly affected: Still – albeit less than in the past – automotive, mechanical engineering, information and communications technology, agricultural and food products

Solutions: Good credit and supplier management

Risk factor 4: Inflation and interest rate hikes

Inflation should first peak in the fall of 2022 and then fall in 2023, predicts Coface economist Christian von Berg. This is not because prices are now falling (e.g., with the help of a gas price brake), but because prices are rising more slowly than last year, she says. But the level of inflation will remain elevated due to rising wages and diversification of production to other countries, she says.

“Central banks will ride on sight,” the Coface economist added. At the ECB, interest rates should rise to 3.5% or higher this year, combined with a controlled shrinking of the balance sheet by ending reinvestment of maturing paper from bond-buying programs. This, she says, will significantly increase financing costs for businesses and could ultimately lead to increased inflation again in the medium term itself. “On consumer loans and overdraft rates, key interest rate hikes have the biggest impact, as banks refinance with the ECB at this higher key rate in addition to their own maturity transformation and refinancing via other banks,” says Christian Piller, product director banking at Aryza. The increases would have less effect on construction financing, as these are usually granted as longer-term fixed-rate loans. These tend to be refinanced through bonds issued by lenders, and their refinancing costs are based on the yield of long-term federal bonds. He also says that expected key interest rate increases have already been priced in to some extent. According to Heiko Walter of Wa-Ka, “Due to strong inflation, the reluctance to spend in private consumption and the aftermath of the Corona years, we expect increased payment difficulties in the next few years, especially in the service sector and the skilled trades.”

Considerations

Industries particularly affected: all

Solution approaches: Close monitoring of customers

Risk factor 5: Corona pandemic

In the Western world, Coface economist Christiane von Berg believes the pandemic will hardly play a role. “China, on the other hand, will have a big wave of infection now due to the new opening policy until there is a contagion.” That could initially strain supply chains with China, which could then in turn relax them when it comes to production. In turn, the surge in demand expected from the post-pandemic economic recovery in China should tighten goods again if supply does not change.

According to Heiko Walter of Wa-Ka, “During the Corona pandemic, many countries protected their companies, and the German economy also remained stable as a result. However, he says, some companies have not yet regained the business figures and profitability of 2019. Nevertheless, “Corona was a turning point, and risk awareness has increased significantly since then,” says Kevin Goßling from data provider Fusionbase. Risk experts in corporate groups in particular have a larger budget at their disposal to keep an eye on crises. People have understood that the world can look different from one day to the next.

Considerations

Industries particularly affected: all

Solution approaches: Insolvency checks, market monitoring, close monitoring of customers

Risk factor 6: Geopolitical factors

“Russia’s invasion of Ukraine has shown companies how important it is to know customers and suppliers – in this case specifically with regard to sanctions,” says Heiko Walter, Wa-Ka Kreditversicherungsmakler GmbH. Even an unknowing violation of the sanctions lists leads to the exclusion of the risk from the credit insurance. Especially the engineering industry and internationally active companies should take adequate precautions in order to avoid discrediting themselves and being subject to sanctions.

An automated comparison of customer data with the sanctions lists is recommended. This reduces both effort and the risk of error. Coface economist Christina von Berg says, “The war in Ukraine should continue similar to the second half of 2022. We don’t expect it to end this year.” She adds that an escalation of the conflict to NATO countries cannot be ruled out, although this option is unlikely. Von Berg says, “We also do not expect an overthrow of the regime in Iran, so the country’s geopolitical situation should change little.”

The Institut deutsche Wirtschaft recently reported as the result of an association survey: “The geopolitical situation has not eased at all. As a result, global production and supply networks remain unabatedly susceptible to disruption.”

Considerations

Industries particularly affected: Industries that remain dependent on Russia or Ukraine, e.g., agricultural and food products

Possible solutions: Hedge country risks

Risk factor 7: Shortage of skilled workers

The shortage of skilled workers will worsen in 2023 as more and more baby boomers retire and this generation cannot be replaced by the following generations. “The focus on studies compared to training has led to a shortage of skilled workers, especially in the healthcare sector and the skilled trades,” says Christina von Berg. Since the shortage of skilled workers means that higher wages would have to be paid due to strong competition, this will also fuel inflation.

“The prevailing shortage of resources – especially skilled personnel – makes it difficult for companies to make data-driven decisions around credit and risk management in real time. That’s why more and more companies are turning to software and data solutions to automate and digitize decision-making processes in credit and risk management,” says Mohamed Ceka, managing director of Wa-Ka Credit Solutions GmbH. Numerous processes that were previously carried out manually can be automated to counteract the shortage of specialists. “In many companies, there is often great potential to save operating costs,” says Aryza banking expert Dietmar Nussböck.

Considerations

Industries particularly affected: Skilled trades, IT, healthcare sector, manufacturing in general.

Solution approaches: Automation of existing processes

Summary

“Both country risks and insolvency forecasts showed large variations last year, and they will continue to diverge in 2023,” says Heiko Walter, Wa-Ka Kreditversicherungsmakler GmbH, “even within Europe, the EU or between neighboring countries, we observe extremely different economic forecasts.”

We can only recommend to constantly monitor all risks regarding customer, industry and country.

Allianz economists predict a 10% increase in global corporate bankruptcies for 2022 and 19% for 2023. “Insolvencies are clearly picking up,” says Anna-Katharina Wichmann of Allianz Trade. “However, this is more of a gradual normalization of insolvency activity after massive fiscal support for the economy in recent years.” Europe has been particularly hard hit by the rise in insolvencies, she says, with the main European markets accounting for two-thirds of the increase. The U.K., France and Italy in particular have seen a significant increase. Of the major economies worldwide, China (+15% for 2023) and the U.S. (+38% for 2023) are particularly affected.

Mitigating risks with Open Banking

Be the first to read our next issue – sign up to our newsletter here

"*" indicates required fields