Case Study – Enpal und Aryza Lend

Enpal, a leading provider of renewable energy solutions, has implemented Aryza Lend to manage its in-house installment model EasyFlex. The platform automates payment processes, handles early repayments, and supports refinancing through external investors. A smooth rollout was ensured through seamless integration with existing systems and thorough staff training. Today, thousands of installment loans are managed efficiently via Aryza Lend.

About Enpal

Enpal delivers an all-in-one energy solution that combines solar systems, heat pumps, battery storage, EV charging stations, and the smart energy trading platform Enpal.One+. Residential and commercial customers can purchase, finance, or rent these systems, eliminating the high upfront costs typically associated with switching to renewable energy. Enpal manages planning, installation, and—on request—maintenance and insurance. With several thousand new energy systems installed every month, Enpal is a market leader in residential solar across Europe and one of the largest heat pump installers in Germany.

Project Challenge

In 2023, Enpal introduced a purchase option for solar systems and heat pumps via its EasyFlex installment model. The financing is provided by banks and institutional investors through Special Purpose Vehicles (SPVs).

This created the need for a powerful software solution to manage installment contracts—one that could handle the complexity of financial rate calculations, correct accounting processes, and seamless allocation of loans to the appropriate SPVs.

Implementation of Aryza Lend

The project began with a detailed requirements analysis, including a review of Enpal’s financing terms and internal processes. Aryza Lend was configured early on to align with Enpal’s specific needs.

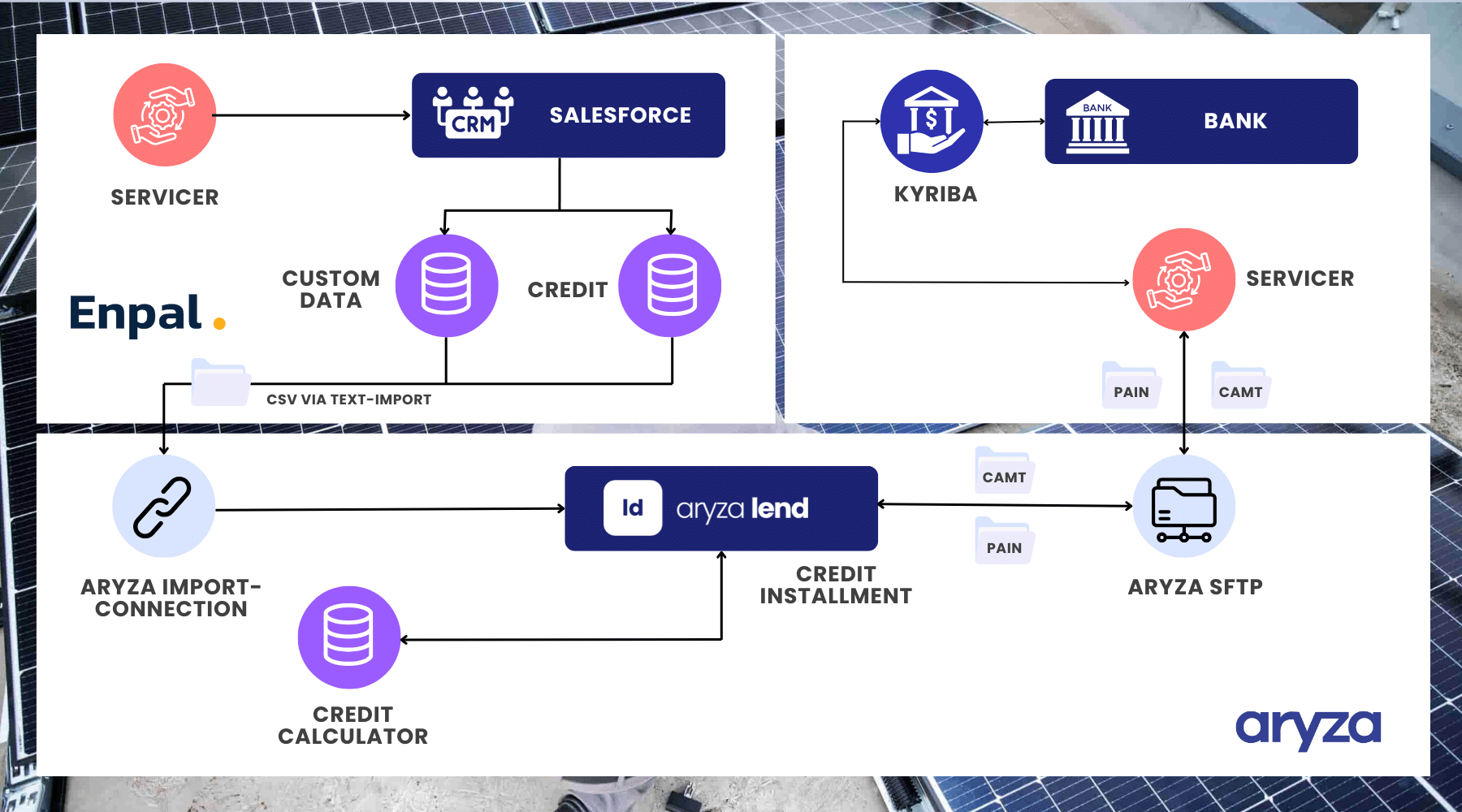

A key milestone was integrating Aryza Lend with Enpal’s payment system. The Aryza API was implemented to provide real-time access to essential data and reporting—ensuring regulatory compliance (e.g., BaFin reporting) and full visibility into performance metrics.

A thorough testing phase ensured the system was stable and ready for go-live. To complete the rollout, Enpal teams received dedicated training to encourage adoption and maximize the value of the new system.

Solution at Enpal

At launch, all existing accounts were imported into Aryza Lend, with ongoing imports of new installment contracts planned.

A total of 46 users were onboarded onto the platform.

Aryza Lend fully automates payment handling: monthly installments are collected and instantly allocated to interest, principal, and fees (via PAIN files). The flexible EasyFlex contracts allow for early repayments—whether partial or in full—which are also processed and recorded automatically.

A standout feature is the system’s support for refinancing via SPVs. Installments are collected through different bank accounts and booked on separate general ledger accounts—keeping accounting clean and transparent.

Customers can log into their Enpal portal to view their current payment schedules and track early repayments. All data is made available in real time via API.

If a payment fails, Aryza Lend reacts immediately: it calculates arrears, initiates a retry, and provides complete reporting for follow-up (via CAMT files).

Naturally, the platform is fully compliant with legal reporting obligations, including ESMA reporting, and generates reports for refinancing partners—ensuring transparency and trust at every level.

Customer Feedback

Aryza has provided us with an outstanding solution tailored to our everyday needs. With a high degree of customisation and a deep understanding of our specific requirements, we now manage both ongoing and new contracts more efficiently than ever.

Laura Wolff, SVP Asset Management at Enpal.