Issue 2: Globalization

Regional Risks: Focus BENELUX

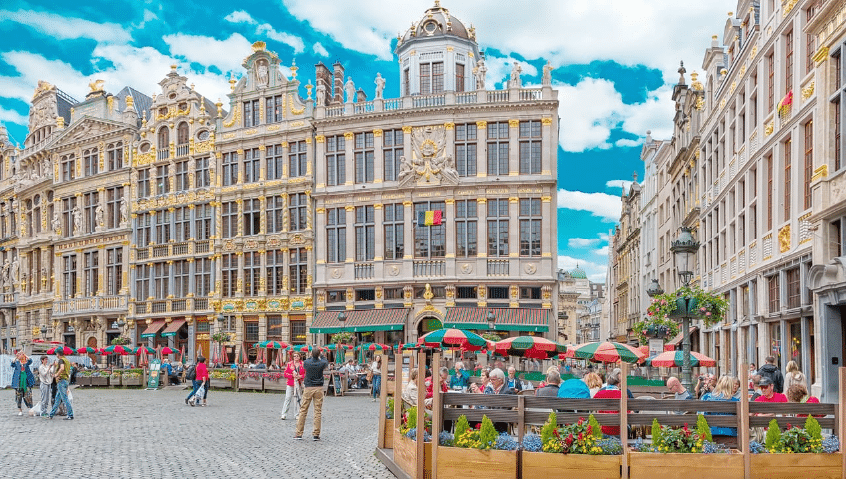

Belgium

Belgium’s economy in numbers 2023

Sources: Coface, Statbel

7.4%

Inflation

-0.1

GDP Growth in %

101.4

Public Debt (% GDP)

828

Corporate Insolvencies (February)

51,849 US$

GDP per Capita

11.5 Million

Population

Strengths

- Optimal location between the United Kingdom, Germany, and France

- Presence of European institutions, international organisations, and global groups

- Ports of Antwerp (second-largest in Europe) and Zeebrugge, canals, motorways

- Well-trained workforce thanks to vocational education, multilingualism

- Strong business environment

- Diversified export structure in terms of products

- High company profitability and equity ratios

- High share of foreign direct investments

- High level of innovation

Weaknesses

- Political and financial tensions between Flanders and Wallonia

- Complex institutional structure and multiple administrative levels

- Heavily dependent on the Western European economy: exports of goods and services = 105% of GDP, of which more than 70% to the rest of the EU

- Exports concentrated on intermediate products

- High structural unemployment

- Heavy public debt

- Tight housing market

- Saturated transport infrastructure

- One of the highest tax burdens on the private sector in the EU

- Very high corporate debt

- High external liabilities

Aryza Assessment

Geert Corbeel

Senior Sales Executive Belgium

Better than expected – the current economic situation in Belgium can be summed up in this sentence. In the wake of crises such as the Corona pandemic, interest rate hikes and the Ukraine war, many experts expected a more significant impact. Nevertheless, there are some difficulties that local companies are facing.

One major problem – especially in competition with surrounding countries – is that salaries are indexed by law and thus automatically adjusted to inflation with a some delay. Others will say that this is why Belgium is doing less bad than feared, as it has saved the purchasing power of the Belgians.

A big fear is that large companies might consider moving to neighboring countries with their headquarters. For many local SMEs, of course, this is not an option. Particularly companies with a high labor Sectors such as the construction industry in particular are also suffering from rising material prices, caused by increasing production costs

Regulatory pressure is also growing. ESG efforts and the protection of consumers, or debtors, are also becoming increasingly efforts and the protection of consumers, or debtors, are also becoming more and more important. However, consumers are also under strain due to high food prices, with high income tax levels at the same time. Even middle-class Belgians are having problems paying their bills. Although citizens have been given state aid for rising energy prices, it has been scattered, so that needy citizens have not benefited sufficiently.

A not-new but very big problem in Belgium is that its community divisions have made the country almost ungovernable at the national level. Belgium has four communities: Flanders, Wallonia, Brussels and also the German-speaking community. As a result, the country has several regional governments and parliaments. This causes major dissension and it costs a lot of money.

One of the biggest consequences is the rising budget deficit, which is currently running at almost 5%. The country has a debt burden of 105% of the gross domestic product. This is going to rise sharply in the coming years. Also due to the rising interest burden. The upcoming elections in 2024 will be very important. If the Flemish-nationalist parties win (in Flanders) and the socialist and extreme left wins (in Wallonia), Belgium risks setting a new world record. In particular, the country with the longest government negotiations. That already stands at 541 days, in the name of … Belgium.

A big plus is the good location between major economies in Europe and that important institutions such as NATO have their headquarters in Brussels.

How Aryza can help

We offer our Belgian customers a wide range of products in the field of automation and digitalisation to meet future requirements. We currently see great potential in the adaptation of digital solutions, especially in the banking and lending sector. From an ESG perspective, it will be increasingly important to help people with financial difficulties. This is achieved, among other things, through our self-service solutions such as Recover, which helps your customers to better manage their debts.

The Netherlands

Dutch economy in numbers 2023

Sources: Coface, Statistics Netherlands

4.0%

Inflation

1.1

GDP Growth in %

47.4

Public Debt (% GDP)

289

Corporate Insolvencies (February)

57,997 US$

GDP per Capita

17.5 Million

Population

Strengths

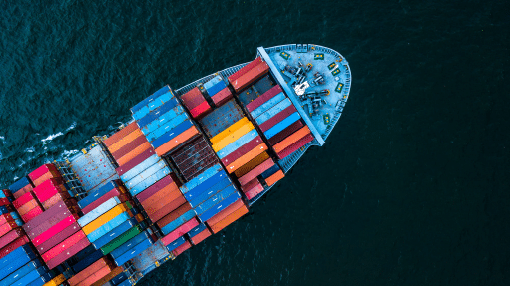

- Port activity (Rotterdam is Europe’s number-one port)

- Establishment of home-grown international companies.

- Diversified and flexible exports (services have a share of 45% in total exports).

- Strong digitalization with lot of home office, home schooling and online retail possible

- High quality infrastructure and good living standards

- Favorable business environment

- Key trade hub in Europe

- Among the largest exporters of crude oil in the world, and the second-largest producer and exporter of natural gas in Europe

- High current account surplus

- Sound public finances

- Healthy banking sector

Weaknesses

- Exposure to the European economy, especially Germany and Belgium (25% and 12% of all goods exports 2021, respectively)

- High exposure to European gas prices (gas represents 38% of total energy consumption, 71% of all Dutch residents heat with gas)

- Debt of private households is very high (230% of disposable income or 102% of GDP in 2020)

- Banks dependent on wholesale financing (loans/deposits = 195% in Q1 2021) and real estate

- Ageing population, pension system under pressure

- Corporate debt being the 3rd highest in the Eurozone

- Very high dependency on the Eurozone economic cycle

- High exposure to a hard Brexit

Aryza Assessment

Aryza Assessment

Aart-George Broekema

Product Director BENE

It is necessary to look at the economic development in the Netherlands from different points of view. The positive outweighs the negative in the short term. Despite numerous trouble spots, there is even hope for slight growth. Although there has been a modest increase in insolvencies, the dreaded bankruptcy wave has not yet set in and is nowhere near the pre-Corona level.

However, good preparation for future challenges is essential especially for large B2C companies, DCA’s and bailiffs. Consumer protection is coming into clear focus in the Netherlands, as in many other European countries. The government is trying to cushion the impact of the poverty and debt problem or solve it wherever possible. This Kingdom-wide approach covers several areas:

-

Preventing problematic debts

-

Unburdening and supporting

-

Socially responsible debt collection

Large companies with many private consumers like telecommunications companies and utilities f.e. will have to think much more carefully about how they deal with their debtors. Fair debt collection plays an increasingly important role not only from an ESG perspective. But regulation is also expected to increase significantly.

The Court of Audit already examined three major government organisations – Tax Authority, CJIB (which collects traffic fines) and CAK (which collects overdue healthcare premiums) – and found out that they do not provide sufficient customisation when collecting tax debts, fines and unpaid health care premiums. It would be necessary to check whether citizens are left with enough living expenses after the payments are made, the Court of Audit concludes. This requirements will sooner or later translate to businesses. Guaranteeing the subsistence level of debtors becomes a prerequisite. Modern software solutions can help to achieve this. Pressure on debt collection agencies will also increase significantly. As part of careful and socially responsible debt collection, the government has made the “Collection Services Quality Act” (Wet Kwaliteit Incassodienstverlening), which will come into force from July 2023, making it mandatory for DCA’s to register and conform to a number of requirements. One of the important requirements: keeping a proper debt collection administration.

Bailiffs too are under mounting pressure to make no unnecessary costs, implement more and stronger regulations, deliver tailor made solutions for each debtor situation, be social responsible and still deliver a huge recovery rate. Due to restrictions in this and other laws and regulations, this is becoming increasingly difficult and only offices with sufficient entrepreneurship and digital support through digital processes will be able to weather this well.

How Aryza can help

Fair debt collection is becoming more and more important. Aryza has been helping DCA’s for years with our software solution Aryza Collect. The development for social responsible dunning is also percolating through at the corporate level. Maintaining subsistence levels will play an important role in the Netherlands. With our data solutions, businesses are well placed to meet these requirements. We also support bailiffs with our solutions and with our user group DipNed.

Would you like to learn more about our solutions? Please feel free to contact me at:

Email: [email protected]

Phone: +31 306 084 411

“As the company grows, so do the opportunities”

Be the first to read our next issue – sign up to our newsletter here

"*" indicates required fields

Aryza Assessment

Aryza Assessment