Customer engagement software to build lifetime value

Speak to a member of the team to find out more about Aryza Engage

Help your customers with their financial well-being, and build stronger brand alliance.

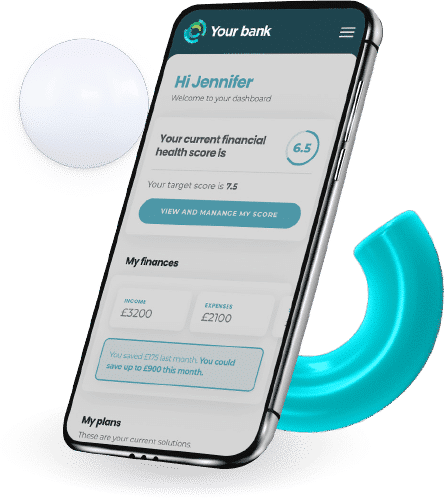

Aryza Engage customer engagement software can provide information including credit scores and financial health indicators . Aryza Engage helps consumers to gain a clear understanding of their income, outgoings and credit commitments, along with ongoing affordability and vulnerability.

Aryza Engage – a simple user interface, completed by the consumer to gain a clear understanding of their income, outgoings and credit commitments, along with ongoing affordability and vulnerability.

With access to a tailored dashboard, your customers can view a unique summary of the products they have with you, along with the balance and payment requirements. They can also see a summary of broader detail on their financial position. With information including credit scores and financial health indicators, Aryza Engage gives your customers a reason to stay on your website, and builds stronger consumer relationships.

The benefits of using Aryza Engage include:

Fully customisable software

Automated decisioning

Build lifetime value

Minimal integration

Assisted journeys

Campaign & workflow management

Reliable data

Find out more about Aryza Engage, download our brochure now

Aryza Engage statistics

47%

of consumers are comfortable using open banking

42%

of Aryza Engage users use open banking to generate a financial health score

72%

of consumers prefer to use our platforms over speaking to an advisor

Additional benefits of Aryza Engage

- Create a new relationship with your customers, offering additional value to your core offering.

- Give extra to your customers with added-value services. Aryza Engage can provide your consumers with services beyond your core products, perceived as added value.

- Help your customers to save money on bills, and check for any extra benefits they are entitled to.

- Help to educate and guide your customers so that they can have a more positive relationship with money.

- Tailored dashboards give a unique view of each consumer’s financial situation.

- Money management and savings tips provided in real time to positively impact customer financial well-being.

FAQ

Yes – it is possible to access bureau information and combine with other sources to create a bespoke view of the customer’s financial situation

Contact us

"*" indicates required fields