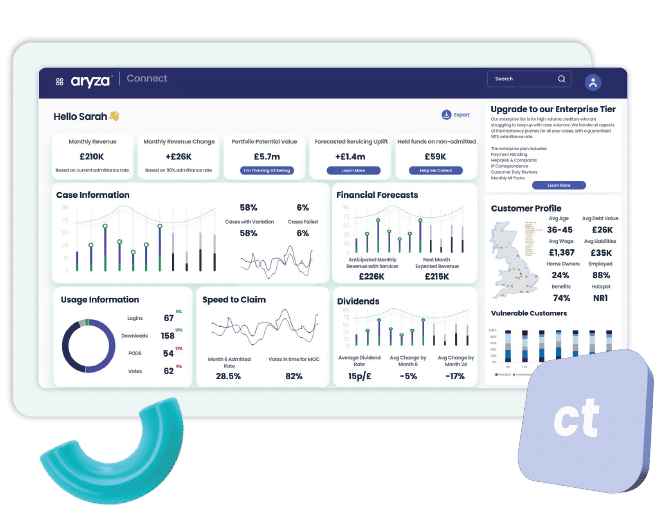

Aryza Recovery Suite

Advanced Insolvency Case Management

Aryza has over 20 years’ experience in the insolvency and debt management sector, and was one of the pioneers of introducing automation. Aryza Recovery Suite offers a complete solution for managing insolvency cases, creditor management and e-learning.

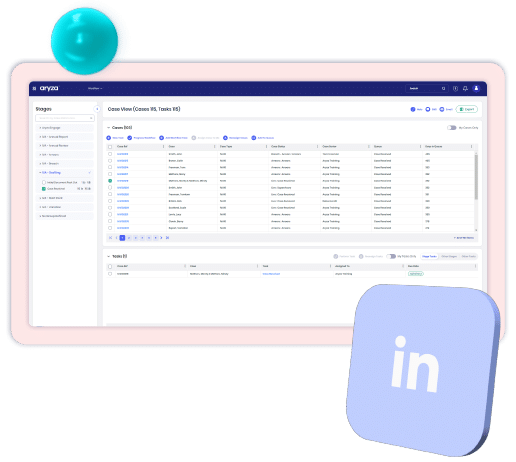

Personal Insolvency Case Management Solution

Corporate Insolvency Case Management

Our heritage in insolvency sector now includes a full Corporate Insolvency Management tool.

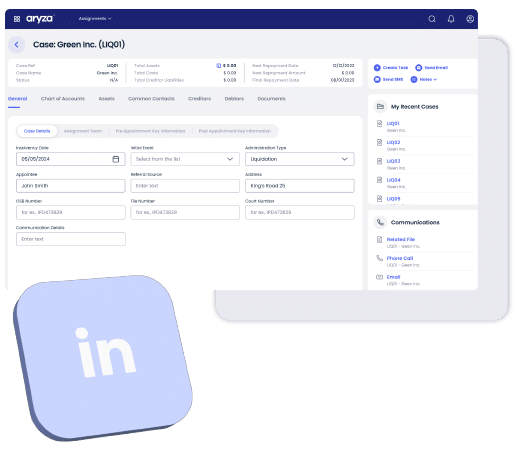

Interaction for Creditors and IPs

Communicate and share information directly between Creditors and Insolvency Practitioners with the touch of a button.