Loan origination software

Efficient solution for financial products – quick, automated and cost-effective

Speak to a member of the team to find out more about Aryza Originate

Powerful loan

origination

software

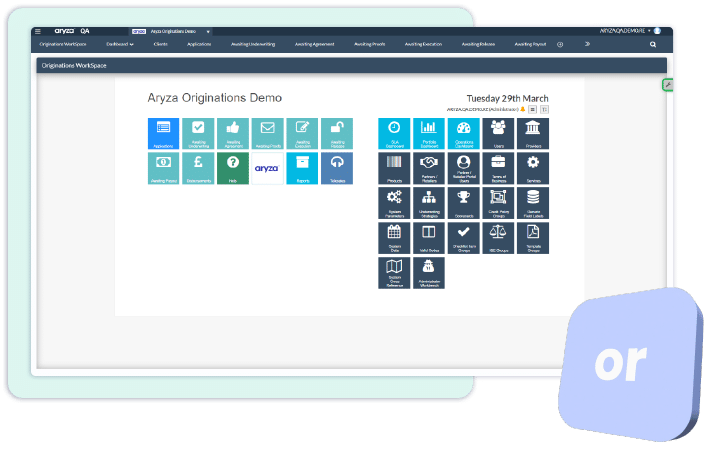

Transform the application process for your customers with a simple, fully digital, and entirely automated loan origination journey. Aryza Originate is a secure, cloud-hosted end-to-end loan management software solution that integrates a powerful decision engine to automate lending decisions and manage credit risk. It’s designed to originate and manage financial products quickly, automatically, and cost-effectively, streamlining the entire loan process from application to approval. Learn more about the key features of this product below.

Aryza Originate has been created to improve backend processes, optimise efficiency and deliver a smoother experience for your customers

Improve backend processes

A smoother experience

Cost reduction

Management information

Regulatory compliance

Speedy processing

Easy application

Embedded finance

Automated Onboarding

Powerful Decision Engine

Find out more about Aryza Originate, download our brochure now

Aryza loan origination solutions

Aryza has a rich heritage of working with lenders and brokers to deliver award winning automation for all aspects of loan origination.

4.4m

applications managed by Aryza Originate

£1.7Bn

value of customers using Aryza loan origination solutions

FAQ

Fast, accurate and efficient, approval of loans at speed while maintaining regulatory compliance

Digital, easily navigable customer journey, cost effective

Aryza Originate was designed with the aim of making the processing of loan applications more efficient. However it contains a whole host of additional features too, which assists through the entire lending journey. Some of these additional features included in the platform are:

– The ability to create and manage loan portfolios

– Centralised document management

– Compliance management

– Automated underwriting

– Customer management

– Billing and invoicing

– Audit trails

For a full breakdown of how Aryza Originate could help your business, please get in touch with our team today for a free demo.

Contact us

"*" indicates required fields