Managing Ecological Risks in Lending – ESG Strategies for Banks

In today’s financial world, integrating ESG criteria into lending practices is not just a matter of compliance, but a strategic imperative that can determine the survival and success of financial institutions. The consideration of ESG factors goes far beyond risk management and should be a central element of the strategic orientation of banks and financial service providers.

ESG Regulation: Status Quo, Challenges, and Strategies for the Financial Sector

The regulatory ESG requirements in the financial sector seem to be growing exponentially. A steady evolution and adjustment of regulations, as seen with the Corporate Sustainability Reporting Directive (CSRD), continues unabated. This dynamic underscores the need to differentiate between various types of regulations.

-

Documentation Regulation – It focuses on the disclosure of information, such as the EU Taxonomy.

-

Risk Management – It is shaped by regulations like the Market Infrastructure Regulation (MIRs), which have integrated ESG aspects in their latest revision.

Clearly, it is no longer sufficient to focus solely on reporting and risk measurement. Instead, risks must be managed proactively. A vivid example of this is the need to capture greenhouse gas emissions emanating from the companies and projects in which investments are made.

This highlights the growing responsibility financial institutions carry regarding the ecological impacts of their investment decisions. NGOs play a significant role in this context. Their push for transparency and accountability has increased the pressure on companies to make voluntary disclosures and analyses on ESG topics.

Another crucial point is the necessity to integrate ESG factors into business and risk strategies. This goes beyond compliance with current regulations like the EU Taxonomy Regulation and CSRD. It requires a deep engagement with social and governance aspects. The associated challenges are diverse, ranging from the procurement and analysis of relevant data to the need for a comprehensive risk inventory, further emphasized by concepts like the Green Asset Ratio (GAR).

Strategies for Effective Data Acquisition and Processing in Lending

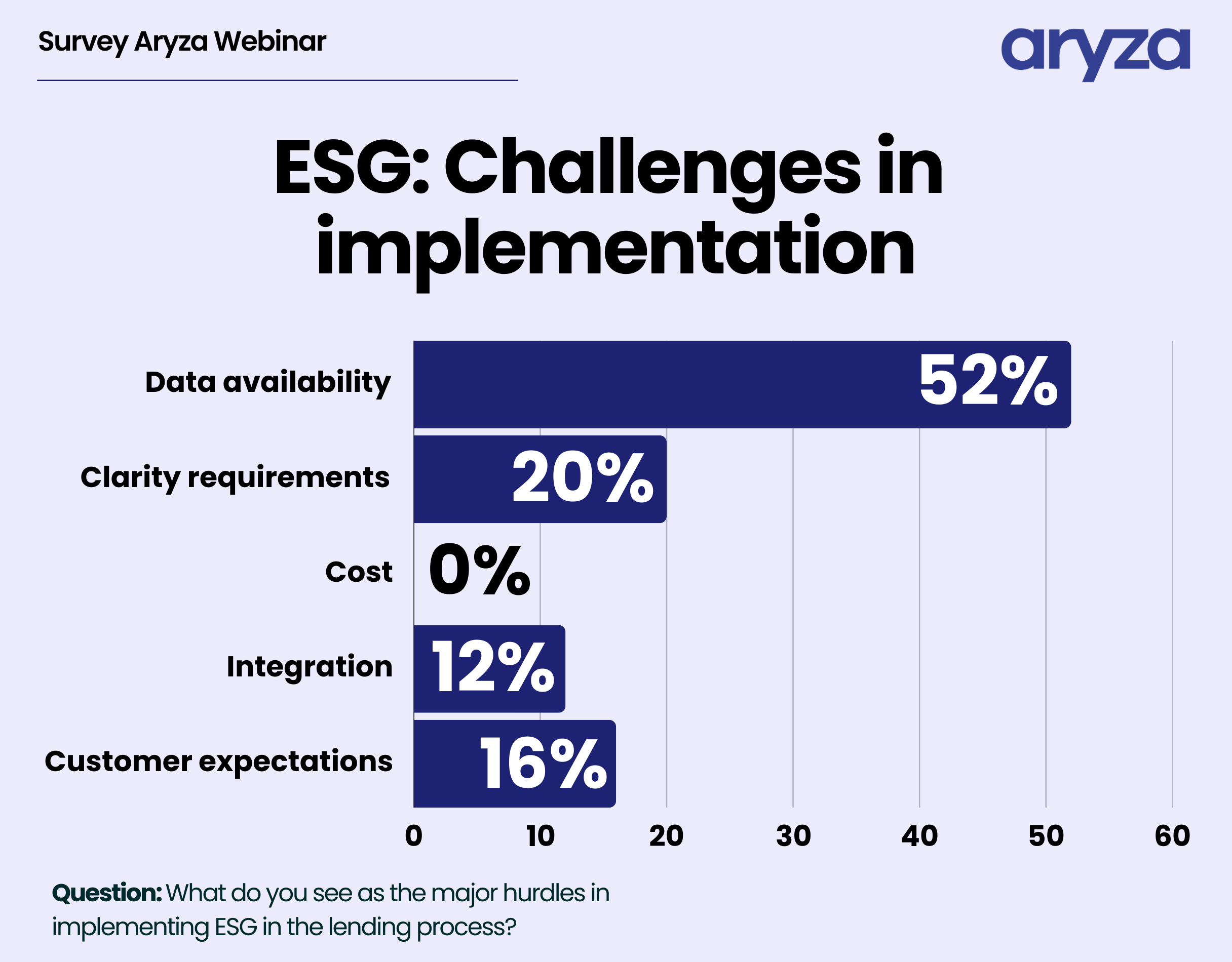

Data acquisition and processing is certainly one of the biggest hurdles for banks and lenders when integrating ESG into the lending process. Institutions need to capture qualitative and quantitative data covering a wide range of aspects – from energy efficiency and greenhouse gas emissions (Scope 1, 2, and 3) to social indicators such as training expenditures and the proportion of women in leadership positions, to governance issues like ongoing litigation or political donations. This information is crucial for conducting an informed ESG assessment that is used for reporting and developing ESG scores.

The procurement of this data is expensive and complex and must be compiled from both internal (customer conversations, company reports, etc.) and external sources (data from providers like MSCI, ISS, Bloomberg, Sustainalytics, and others).

Furthermore, finding strategies and understanding one’s own ESG goals within the organization is challenging. Many institutions struggle to clearly define their ESG strategy and effectively integrate it into their business processes. However, effective communication and training on ESG topics within the organization are crucial for creating a shared understanding of sustainable goals.

Moreover, the quality assurance of the collected data plays a significant role in ensuring the reliability of ESG scores and assessments.

The Complexity of the ‘E’ in ESG: Environmental Issues in the Focus of the Financial Sector

In the debate on ESG criteria, the “E” for environmental issues often comes to the forefront. This dominance is also reflected in regulatory innovations (e.g., the 7th amendment to MaRisk) and raises questions about whether the environmental component is the biggest challenge in data acquisition and implementation. Environmental aspects, especially global warming and greenhouse gas emissions, are tangible yet complex to deal with. The measurement and assessment of environmental risks, such as quantifying CO2 emissions, are directly feasible, but expanding the focus to issues like biodiversity shows the limitations of current methodologies.

The challenge lies not only in the complexity of the subject matter itself but also in how non-quantitative risks can be effectively integrated into assessment processes. Compared to the S and G dimensions of ESG – which are naturally more qualitative – a continuous development and adjustment of assessment methods are required. Uniform frameworks and guidelines are important to ensure consistent evaluation and analysis.

Differences and Challenges for SI’s and LSI’s

SIs (Significant Institutions), which are directly supervised by the European Central Bank (ECB), generally face more extensive reporting obligations and detailed disclosure requirements compared to LSIs (Less Significant Institutions) that are controlled by national supervisory authorities.

This distinction reflects the principle of proportionality, which adjusts the requirements for reporting and disclosure to the size and complexity of the institutions.

An important point in this context is the introduction of the CSRD (Corporate Sustainability Reporting Directive). It allows smaller institutions to provide certain ESG-related reports and data at a later stage. This gradual integration still poses a challenge for smaller institutions to collect and process relevant ESG data to meet future requirements. The development and implementation of ESG scoring/rating models are a crucial step for financial institutions to fulfill their ESG obligations. These models enable a differentiated assessment of the ESG performance of companies and projects but require careful consideration of quantitative and qualitative data as well as alignment with the institution’s business and risk strategy. A consistent process – from data collection to provisioning for risks – that is transparent and verifiable both internally and by regulatory authorities, is important.

ESG Integration in Risk Assessment and Pricing

ESG criteria significantly influence the risk assessment and pricing of loans. The risk evaluation process begins with data collection to determine specific ESG scores. These can be considered in the rating as a factor and thus directly influence the probability of default (PD). They are also the basis for developing a dedicated ESG rating. The weighting of the “E” aspect has become significantly important in many cases, however, a balanced assessment that adequately considers all ESG aspects is crucial.

ESG also changes the pricing of loans. Institutions can incorporate ESG-related aspects into loan conditions using scoring models. This requires careful consideration between promoting positive ESG performances and accounting for potential risks.

An interesting concept is the “greenium,” the price difference between conventional and sustainable financial products, which can directly affect refinancing costs and thus loan conditions.

The double materiality analysis from the CSRD introduces a new perspective into ESG integration by asking not only how environmental and social factors affect the company but also how the company impacts these factors.

This opens up a new dimension of risk and impact assessment that is important for internal strategy development and external reporting.

Integration of ESG Scenarios into Risk Provisioning: A Practical Example

An end-to-end process is essential for assessing and managing ESG-related risks. This approach allows for a more precise risk evaluation (e.g., for properties that may be less energy-efficient or present unique governance challenges) and promotes transparency within the organization.

A key component is the Expected Credit Loss (ECL) methodology, which enables differentiated risk provisioning. It benefits from the incorporation of specific ESG scenarios that simulate potential long-term risks and their impacts on creditworthiness, for example, implemented with the Aryza software solution Aryza Evaluate. By applying ESG-related scenarios based on macroeconomic factors (e.g., from databases like the Network for Greening the Financial System), financial institutions can quantify the impacts of ESG risks over the entire life cycle of a loan.

This allows for the direct effects of ESG factors on the credit portfolio to be assessed and preventive measures to be implemented into risk provisioning. Documenting and justifying each step ensures high traceability and contributes to the credibility of the risk assessment.

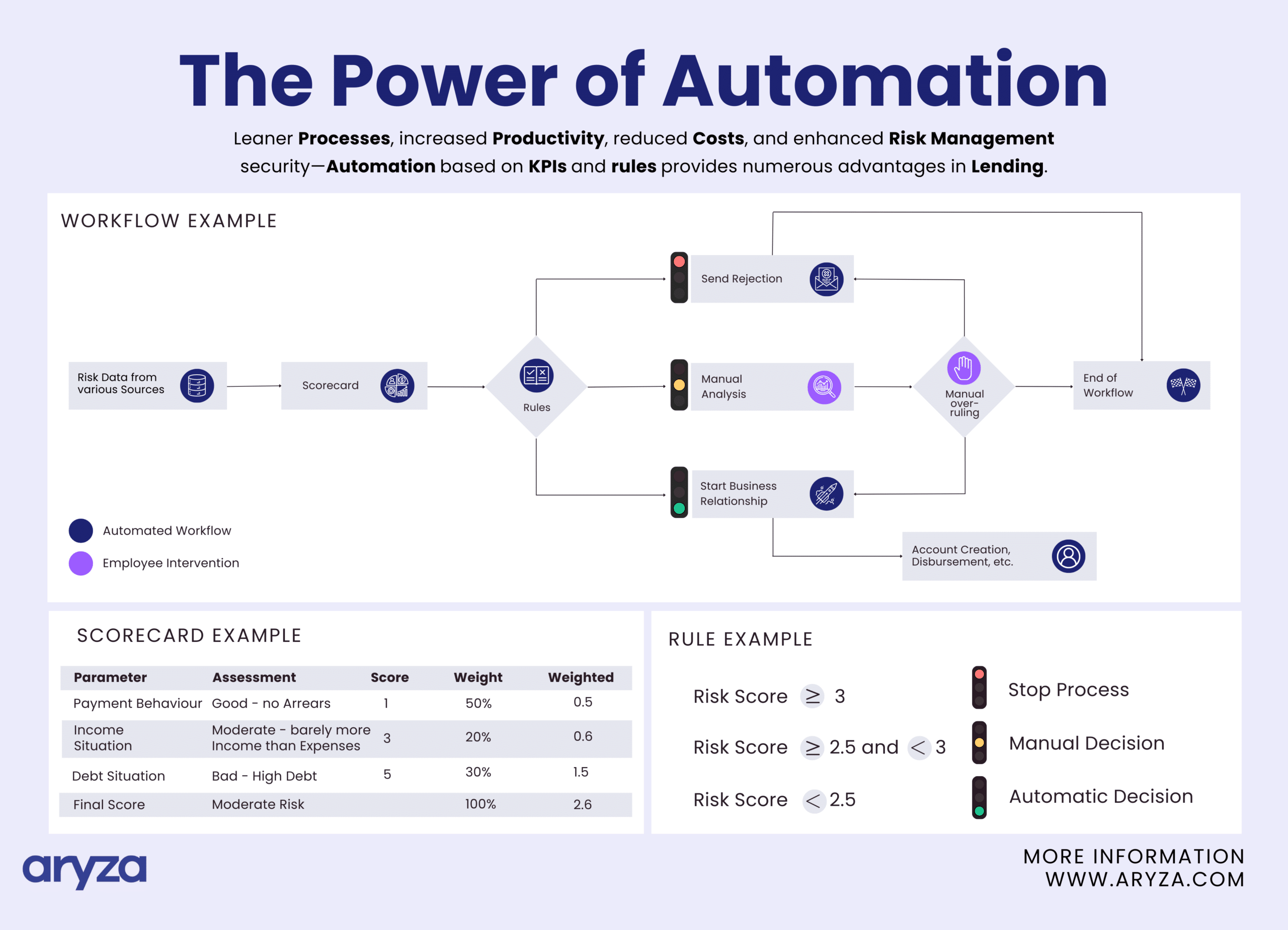

Integration of ESG Factors into the Lending Process via Software

The implementation of ESG criteria into the lending process requires seamless integration into existing systems. Modern application portals like Aryza Originate enable end customers to provide data necessary for evaluating ESG aspects, e.g., information on the energy efficiency of properties, which is important for construction financing and assessing environmental risks.

External data providers, conducting assessments based on account data or other available information, are becoming increasingly important. About 75% of all institutions are already using such services to supplement their ESG assessments. However, this also means a growing dependence on external data sources for comprehensive ESG analysis.

After data collection, the next step is the consolidation and standardization of this information to feed it into automated evaluation systems. These systems enable the determination of ESG-adjusted prices for loans, thus directly incorporating ESG performance into loan conditions. An interesting concept in this context is the inheritance of data within conglomerates, supplementing missing specific data with more general group data. Throughout the further course of the lending process, continuous updating and monitoring of ESG scores are necessary. A flexible IT infrastructure capable of processing regular data updates and integrating them into the evaluation and decision-making process is absolutely necessary.

Contact us

"*" indicates required fields