Issue 3: Customer Centricity

Customer Centricity

Why Consumer Duty is forcing companies to rethink

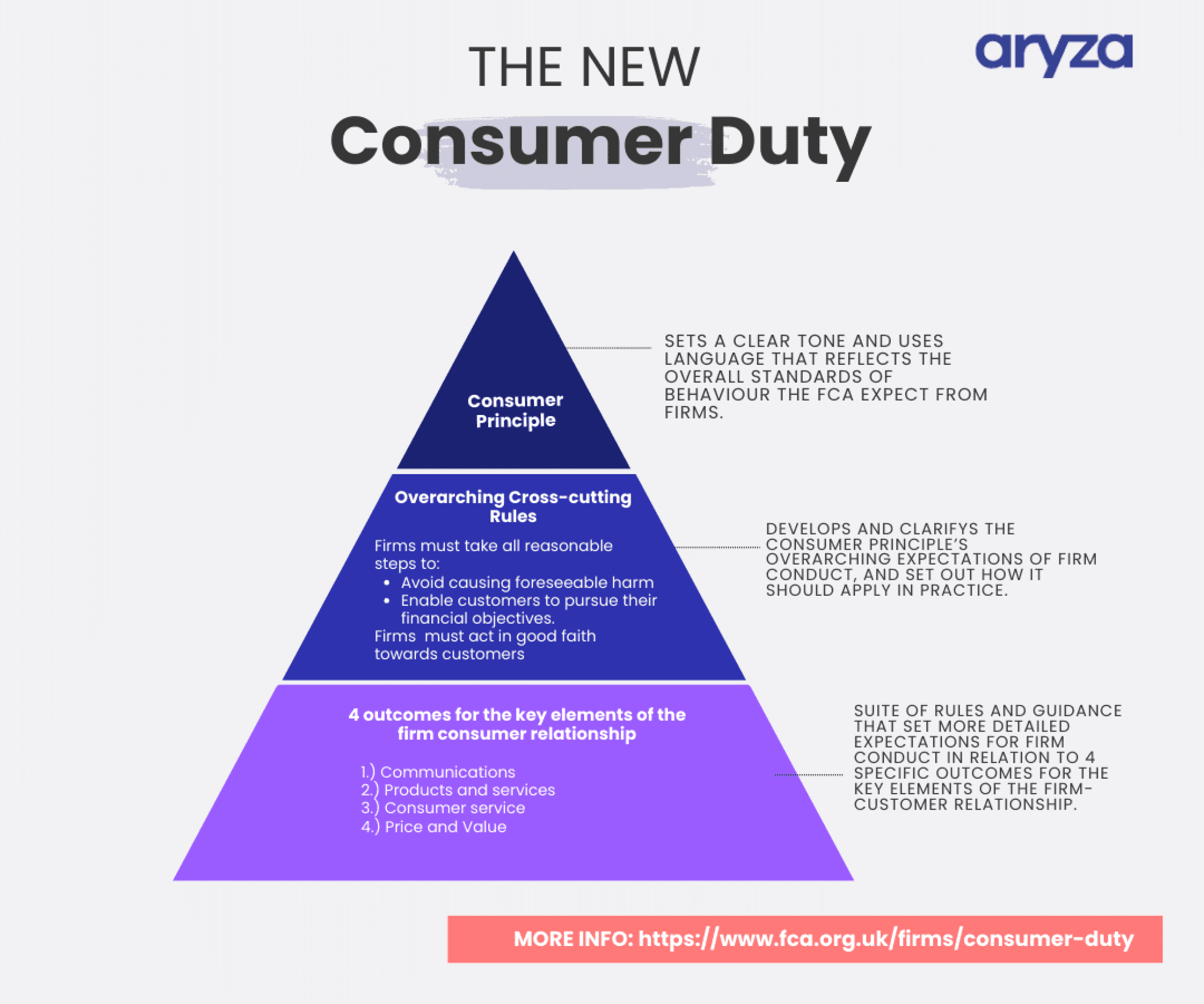

Consumer Duty

Consumer Duty is a regulatory initiative by the Financial Conduct Authority in the UK aimed at elevating the level of consumer protection in the financial industry.

It requires financial firms to act in the best interests of their customers, provide suitable products, services and value for money.

Consumer Duty came into force on 31. July 2023

15%

Recent survey data indicates that 15% of adults reported increasing their borrowing in response to the cost-of-living pressures at the end of 2022.

£65.5K

The average total debt per UK household in April 2023 has shown an increase when compared to previous years’ data and trends.

1.2M

Around 1.2 million households are facing insolvency due to higher mortgage payments and living costs in 2023.

Interview

In this interview, Colin Brown discusses the requirements of Consumer Duty, the impact of the global crises on banks and lenders, the pros and cons of AI, and the company’s plans for the future.

Consumer power is growing in the retail financial services market, especially in the UK, where Consumer Duty came into force on July 31.

The customer is at the centre – this whole idea is already included in our mission statement. It has a lot of parallels with the FCA’s Consumer Duty requirement. At our core, it’s about our customers striving to have the best possible relationship with their customers. How do they do that? By protecting their customers at all times, treating them fairly, and making sure they get the best possible outcome.

How do we get involved?

In our consumer products, we use various Open Data streams: Open Banking, Open Finance, Open Tax, Credit Bureau Searches, CRO Lookups, to name a few. With these tools, we can quickly build an individual’s financial profile. For example, using a combination of the various Open Data feeds, our software can calculate loan rates that a debtor can afford. We take the error-prone – and possibly interest-driven – human element out of the process. The technology makes the decision.

Will Consumer Duty noticeably change the way companies behave?

The recognition of treating consumers fairly is not new, but it has come more into the spotlight since Covid. A culture of helping affected customers has been established in banks and among lenders during the pandemic. Forbearance with vulnerable target groups was noticeable during this period, for example, by suspending payments. The problems have not become less. Covid was followed by the Ukraine war and the cost-of-living crisis; inflation and rising mortgage costs have been added to the mix. Our solutions are made to always keep the end customer in mind.

Do you think the principle of Consumer Duty will happen across countries?

Yes, I believe that Consumer Duty and the principle of TCF (Treating Customers Fairly) will be embraced internationally and be successful. To come to that conclusion, you can look at the evolution of the GDPR, which was set up in Europe and has spread around the world in different variations. Because of the GDPR, there is global awareness of how consumer data should be hosted. Consumer Duty will develop in a similar way. UK, as the country currently spearheading Consumer Duty, is also the leading market in the Commonwealth. This will trigger a chain reaction in the other Commonwealth countries. In addition, financial inclusion is also an area of diversity, which is a huge topic internationally. It’s simply a matter of ensuring that people who are under severe financial pressure also have options and quality of life.

Do companies and banks that implement Consumer Duty as quickly as possible have a competitive advantage?

At Aryza, we’ve been looking closely at these components of Consumer Duty for years anyway and implementing them into our product portfolio. As far as banks and lenders are concerned, Consumer Duty is a regulatory requirement and implementation is mandatory. Conscientious implementation not only supports a company’s reputation, but it also has a positive economic impact. A customer who experiences support will make purchases in the future. I believe that it is in the interests of banks and lenders to implement Consumer Duty quickly.

In the face of numerous crises, implementation is a tour de force?

That’s right, there are a bunch of risks right now that have formed into a perfect storm. Be it the cost of living crisis, the war in Ukraine, the ongoing trade wars, rising inflation, global warming and climate. All of these are creating pressure on businesses these days and causing a lot of uncertainty – and most importantly, pointing to a further increase in debt that will no longer be sustainable. Interestingly, this development is not yet visible everywhere!

Why do you think that is?

For example, in the use of our products. We expected that, given the economic environment, our Insolvency division in particular would see an upturn, but it’s our Lending division that’s booming. Many people are still taking out loans. Arrears on mortgages remain at an all-time low. We are in the strange and eery situation where all market conditions point to a global recession, but that is not visible anywhere.

How can we help here? …

Are consumers equally affected by the crisis?

In Germany, the volume of receivables in corporate insolvencies has recently skyrocketed. Much larger companies are affected.

Speaking of tech. Everyone is talking about AI, how is Aryza dealing with that?

We are looking at some initiatives in artificial intelligence. We have a large treasure trove of bankruptcy data. We are currently working on models that can make predictions about the likelihood of arrears. This would give companies the ability to proactively reach out to their customers to mitigate threats at an early stage. We are also looking into developing a personal insolvency score. This would help banks and lenders make even better predictions about the affordability of potential borrowers who are just coming out of bankruptcy. In general, though, I think caution is advised when using AI in financial services. Do we really want AI to assess credit risk and do Evaluate’s job? I don’t think we should overstate what AI is currently capable of. Of course AI will become more relevant, but I don’t think it will completely replace the human element.

“Competitive disadvantage”

Helen Lord from the Vulnerability Registration Service on Consumer Duty

Will Consumer Duty noticeably change the way companies behave?

Consumer Duty places more onus on regulated firms to consider treatment of customers, not just at the acquisition stage, but throughout the customer life cycle. That will include account management, renegotiation of terms, marketing, product targeting, customer service – right through to collection

Which topics are the most important ones from your point of view?

Consumer Duty makes specific reference to vulnerable customers and the fact that they are more susceptible to harm. It underlines the fact that every effort should be made to identify any vulnerable circumstances and adjust behaviours to achieve the best outcomes. This means that organisations should use available means to identify vulnerability in their customers and from the perspective of VRS, this means that they should be using our database which is a unique source of data with the sole purpose of identifying vulnerability in customers.

Do you think the principle of Consumer Duty will happen across other countries?

Consumer Duty is simply a requirement for firms to treat customers in the right way and it is likely that other countries will mirror the regulation. However, the regulation is only the framework for good customer management that should be embedded.

Do companies and banks that implement Consumer Duty as quickly as possible have a competitive advantage?

It is a regulatory requirement and action will be taken if it is not complied with – at the very least, it would be competitive disadvantage not to comply with Consumer Duty. Consequences could not only involve fines but serious reputational damage. However, there are huge advantages to being compliant – this extends to the social good.

8 steps for more customer centricity

Be the first to read our next issue – sign up to our newsletter here

"*" indicates required fields