Loan management software built to accelerate & automate the full loan lifecycle

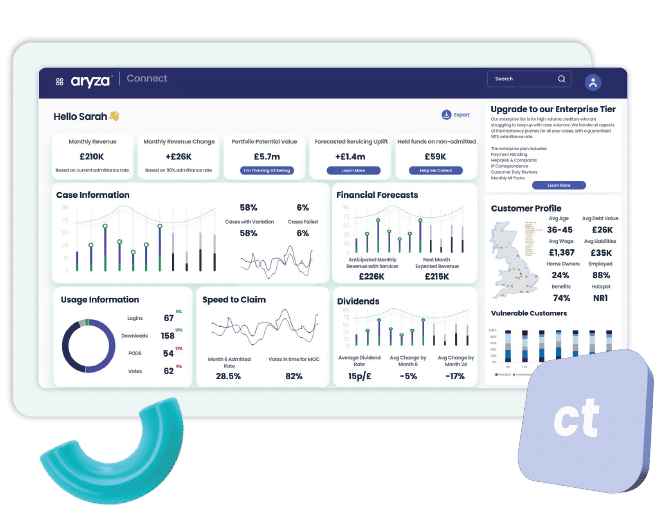

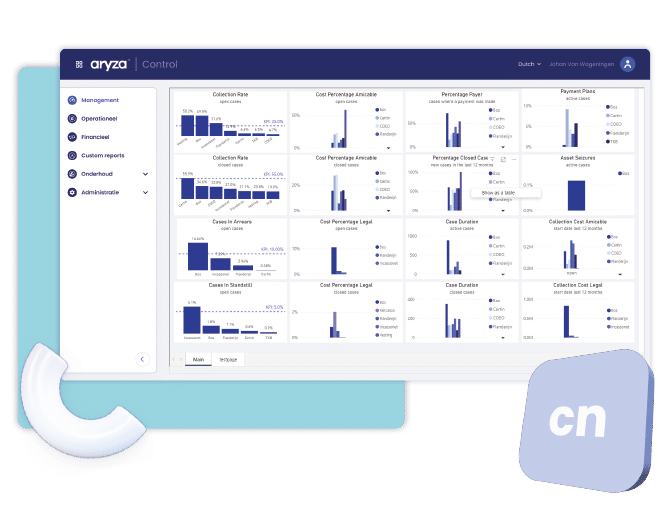

Our cloud-hosted platforms support the entire lending lifecycle, from application through management and onto collections when necessary. Lenders can benefit from a holistic view on one single platform, facilitating the smoother running of operations and resulting in greater customer satisfaction.

Credit checks, AML checks, and an accurate view of applicants financial position via Open Banking

Rules-based decisioning means that part of the application process can be safely automated, with customers enabled to securely provide critical mortgage information via digital platforms. We have tools that can help customers who are struggling with repayments, as well as automating some payment break management and arrears processes.

Solutions our software is for

Benefits

FLorem ipsum dolor sit amet, consectetur adipiscing elit. Risus tristique iaculis ipsum a. Vel tellus nibh nulla cursus platea. Vel, amet enim iaculis facilisi in ac amet, nunc. Fusce laoreet vel tellus, ullamcorper ut mattis habitasse.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Risus tristique iaculis ipsum a. Vel tellus nibh nulla cursus platea. Vel, amet enim iaculis facilisi in ac amet, nunc. Fusce laoreet vel tellus, ullamcorper ut mattis habitasse.