Debt & Insolvency Case Management Software

An end-to-end solution for managing the complex bankruptcy process, iron clad compliance and tailored to meet jurisdictional requirements

Speak to a member of the team to find out more about Aryza Insolv

Our clients use Aryza Insolv to file from 100 to 13,000 estates per year

What sets us apart from the competition?

We built, designed, and continue to refine our software for all Licensed Insolvency Trustees (LITs) firm’s business models. Firms of all sizes can configure the Aryza platform to replicate their process, either cradle to grave processing or highly efficient hub processing.

Aryza Canada Bankruptcy & Proposal Case Management System includes:

Accounting

Keep track of all financial transactions via the Aryza system, efficiently manage receipts, disbursements, and account transfers.

- GAAP compliant accrual or cash accounting

- Receipts

- Disbursements

- Bank reconciliation

- Transfer between accounts

- Debtor payments EFT-PAD

- Payments (cheques) – approved, pending

- Easy cheque signing.

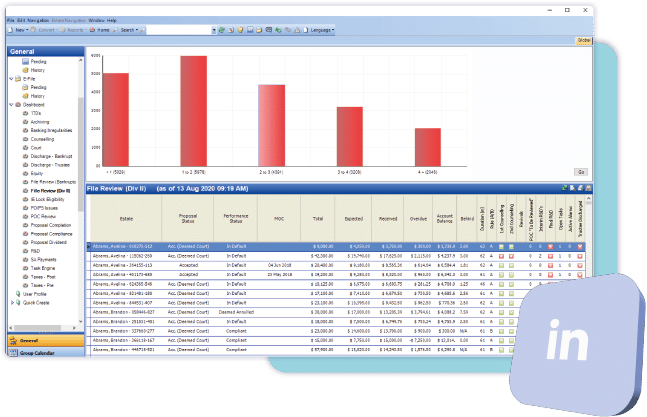

Dashboards

Our software facilitates secure, automated digital reports and management information to save you time and money, and to increase your visibility of all cases.

21 Insolvency processing dashboards for:

- Management

- Operational

- Exception.

Reporting

Our software facilitates secure, automated digital reports and management information to save you time and money, and to increase your visibility of all cases.

- Creation of case forms – Statement of Affairs

- Creation of accounting reports – Detailed Trial balance

- Custom reports – built in designer

- Categorization of reports – Management, case & accounting

- Optional analytics self-service reporting module.

Administration

Many of the administrative and operational tasks are automated, freeing up time to concentrate on getting the best outcome for customers.

- User Profiles

- User Licensing & activation

- Roles & Permissions

- Functional group setup

- Auto task

- Auto reply messaging

- Look up set-up.

One touch automation

Initial filing process manages and automates the process of creating an estate and automatically filing the forms to the Office of the Superintendent of Bankruptcy.

- Key Areas of Automation

- Initial filing process

- SRD automation

- Task Automation

- Auto documents

- Consumer payments and banking

- Creditor notifications.

Client Portal

Optional Aryza product or custom portal integration, client facing self-service portal to help customers to manage their accounts.

- Customer communications

- Document management

- Estate Compliance

- Calendars

- I & E and budget tools

- Credit Rebuilding tools.

Integrations

Included in License Fees, Aryza has set up partnerships with some of Canada’s top businesses to give you access to a broad range of complementary services.

- Canadian Black book Vehicle look ups – fully integrated

- Canada Post Address Complete – fully integrated

- Paperless documents management

- MS Office products – email & calendar integration

- BMO Credit Rehabilitation Program.

Debt Management software to automate your business

Aryza provides a powerful and intuitive platform to manage all aspects of your cases. From capturing debtor data directly from your website to seamless integrating with your existing systems, our open API and Form 65 built-in feature ensure an efficient and compliant process.

Say goodbye to manual tasks and time-consuming processes by automating key workflows, such as document generation, client communication, file management, and more.

Our integrated solution facilitates a smooth transfer of lead information, ensures continuity and eliminates data duplication, saving you valuable time and effort.

Help your customers with their financial well-being, and build stronger brand alliance

Aryza helps you build stronger relationships with your customers, providing a fully customizable platform to engage with your customers and help them stay on track with their debt solution.

The easy to navigate dashboard provides consumers with a clear understanding of the status and progress of their chosen debt solution, including their current income, expenses, and upcoming appointments or payment commitments.

Key features include secure document uploads, monthly budget submission and automated data pre-population. The software also automates contact strategies through email and SMS to facilitate consumer progress and case status updates.

Aryza Canada insolvency services also include:

Speak to a member of our team to find out more about our end-to-end capabilities

Our fully-featured software caters for different types of businesses in credit, collections and debt sectors

Simple to customise and build into your business

Maintain customer relations

One tool to manage your operation

Consistent and compliant approach to insolvency

Tried and tested omnichannel approach

Follow ups

Analytics

Empower customers

White-labelled platform

Reduce operational costs

Contact us

"*" indicates required fields