Exam training, services and peerless products for Insolvency professionals

Insolvency exam training

CPD

ITIQ/ITIQ+

Personal Insolvency Solutions

Compliance toolkits

JIEB Exam Training

Joint Insolvency Examination Board (JIEB) Exam Training

With four qualified exam trainers, we’re able to offer peerless service across all 4 of our core exam training programmes.

Aryza Regulate provide the only face-to-face study programmes for JIEB, CPI and CPPI (in London & Manchester only) in the industry. We know that having a face-to-face connection with your Learning Mentor and other students boosts pass rates by up to 38%.

In addition to our face-to-face programmes, we also offer 2 distinctively different Distance Learning Programmes.

Distance Learning

Our core Distance Learning Programme is designed to deliver high quality and practical training. Depending on the course, you’ll receive all of our study materials, our E-Manuals, full Learning Mentor Support and monthly Zoom calls to ensure you’re ready to sit your exam.

Distance Learning + Passing The Exam Course

Our hybrid Distance Learning experience. You’ll receive everything included within the Distance Learning Programme, as well as an extra course at the end of the programme, designed to get you to pass your exam. In this course you will sit your mock exams, learn key exam preparation techniques, as well as prepare your routine for your big day. (Available for JIEB, CPI and CPPI only)

Continuous Personal Development

Partner In Learning (ICAEW Certificate in Insolvency)

CPD

Whether you’re looking for a digital solution or training delivered directly to your office, we’ve got the perfect option for you and your team.

CPD TAP

CPD TAP is the only fully online, verifiable, up-to-date CPD service available to the insolvency and restructuring and Debt Management sectors.

CPD TAP is frequently updated with news from around the industry. Whether it’s legislation changes, a particular case that’s gone through the courts, or interviews with industry leaders, there’s always something to keep up-to-date with.

We also cover CPD for the Debt Management sector, as well as Scottish Law.

Bespoke CPD

Need bespoke CPD delivered to your entire team? We’ve got you covered. We are able to write the bespoke course for you, on either a subject of your choosing or chosen by us and deliver it with dual branding either face-to-face or online.

Introduction To Insolvency Qualification

ITIQ

ITIQ

Our Introduction To Insolvency Qualification is designed to relieve the stress of starting out in an insolvency practice with practical, useful and foundation building learning.

Over 25 webcasts, you’ll get an introduction to CVA’s, CVL’s, MVL’s and much more.

ITIQ also includes our AML Training Course, designed for Insolvency Professionals.

ITIQ+

Introduction To Insolvency+ is our premium introductory programme for people wanting to work within the insolvency and restructuring sector.

In addition to our classic ITIQ programme, you’ll receive 6 Live Monthly Webinars to help you focus on some the most difficult topics covered in ITIQ, access to 3 of our Becoming a Professional webcasts and our AML Training Course.

Personal Insolvency Practical

PIPS

We offer a whole suite of services to our clients within the Debt Management sector. Whether it’s training or compliance services, or something more bespoke, we can offer it.

PIPs

Who should take the PIPs?

- Those pursuing a career in an IVA specialist company

- Professionals wanting to progress within Debt Management Plan Companies

- Anyone working within other businesses that offer advice and long-term debt solutions to individuals

- Anyone who is seeking a career change and is considering a career in advising about personal debt or finance.

PIP1

PIP 1 is designed for ‘entry level’ members of the team (0 – 18 months in the role), mixing essential information about different types of debt management solutions (both ‘formal’ and ‘informal’), mortgages, tax returns, benefits, property ownership, banking, basic accounts, vulnerable people, etc …

… with essential interpersonal skills, such as key communication skills, telephone manner, types of questions, listening and conversation management. Positive, useful, practical skills.

During the five webcast sessions, and follow-up exercises, we also introduce delegates to key personal insolvency and debt management information. To place this qualification into a training context, this qualification would be ‘pre-CPI/CPPI’ and useful for new starters and those with little, if any, experience of the communication with, and handling of, individuals with personal debt.

PIP2

PIP 2 is a practical and highly bespoke alternative to CPPI (or CPI) for members of the team who have been in the business for between six months and two years. It offers reasonably experienced members of the team a gilt-edged opportunity to advance knowledge about very specific aspects of personal insolvency and debt solutions, ranging from Debt Management Plans, Debt Relief Orders, consolidation loans, vulnerable customers and IVAs… to Bankruptcies and more practical solutions.

The materials, exercises, discussions and case studies deal with the law in a very relevant way. In a dynamic and highly energetic training environment the candidates also explore definitive behavioural skills, such as dealing with confrontation, asking active questions, positive language and assertiveness.

The training consists of five webcast sessions, as well as interspersed exercises. PIP 2 works for everyone in your business who is versed in the basic skills and vocabulary of IVAs, Debt Management Plans and other debt solutions and who want to build a career in the profession.

PIP3

PIP 3 is designed to be a course for more experienced (and qualified) members of the team, dealing with technical issues such as more complex matters such as dealing with a residential property under the IVA Protocol and more complicated assets and issues.

The course materials also include all key legal and case law updates. As an essential part of Sessions 2 and 3 we also explore together the central supervisory and managerial skills which will enable talented members of your team to move upwards in their career.

The course is delivered in a highly interactive environment, challenging delegates to think out of the box and to deal with issues that have a direct impact on how they do business. This qualification is positioned to enhance the skills of those in the business who are ‘post-CPI/CPPI’ and who either do not want to study for the Joint Insolvency Examinations’ Board’s papers, or who require more bespoke development.

Personal Insolvency Compliance Services

The Insolvency Service recently stipulated that regulatory bodies must not only increase their visits to Volume IVA providers, but make them much more rigorous, which will include ‘continuous monitoring’ of such businesses.

From previously receiving very few formal compliance visits, Volume IVA providers can expect more, and as many as one a quarter, especially if more than £50,000 of business is written in that period.

Our Expertise

Aryza Regulate has expertise in compliance and training.

We understand that training is a key component of your business’ compliance, rather than finger pointing.

We have a dedicated team of professional trainers, which places us in the perfect position to work with a business and its team members to not only become fully compliant with the law and SIP 3.1, but to offer the best service to its clients.

Services

Compliance reviews of cases, offering suggestions, input, advice and areas of improvement

- Training to team members in areas that have been found to be non-compliant to ensure the errors and shortfalls are not repeated

- Ongoing technical advice and know-how

- Bespoke assistance that includes variations on all of the above to ensure that your business is run smoothly and efficiently

Contact us for your bespoke quotation on our Personal Insolvency Solutions

Toolkits

Aryza Compliance Toolkits

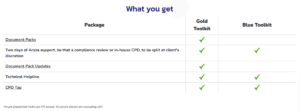

The complete kit for your business, much more affordable. Our toolkits are the best way to get all of the essential services an insolvency practice needs. Whether this is CPD, Compliance, *Document Packs or even our innovative technical helpline, we will not only beat the price of what you’re paying at the moment, but we’ll give you a better service.

Our toolkit packages are:

Aryza Gold Toolkit

Aryza Blue Toolkit

Aryza Gold Toolkit Replenish

Aryza Blue Toolkit Replenish

Speak to a member of the team to find out more about Aryza training and compliance packages

Contact us

"*" indicates required fields