Collection software

Comprehensive solution for accounts receivable and debt recovery management

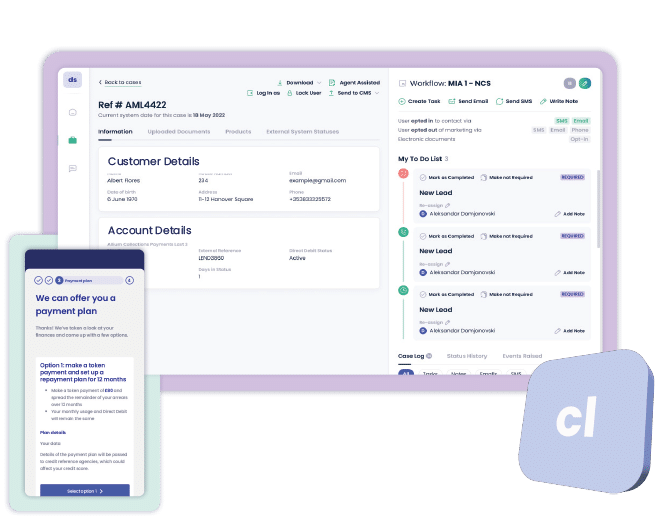

Streamline Your Accounts Receivable and Debt Recovery with Aryza Collect

Aryza Collect optimizes accounts receivable and debt recovery processes, providing a seamless experience for both businesses and customers. This unified solution is designed to meet the evolving needs of organizations in today’s fast-paced financial environment, ensuring that businesses can effectively manage their receivables while supporting customers facing financial challenges.

This comprehensive solution automates the entire process of managing accounts receivable, payment plans, and debt recovery. With a focus on both B2B and B2C applications, Aryza Collect offers a simple and user-friendly interface that equips businesses with the tools needed to reduce overdue receivables, improve cash flow, and foster positive relationships with customers. By integrating advanced technology and automation, Aryza Collect ensures a swift and effective recovery journey that not only benefits businesses but also supports consumers in achieving financial stability.

Key Benefits of Aryza Collect

End-to-End Automation

Customizable Workflows

Scalable and Flexible

Enhanced Customer Engagement

Data-Driven Decision Making

Improved Cash Flow

Robust Reporting Tools

User-Friendly Interface

Integrated Communication Channels

Risk Mitigation

Statistics Aryza Collect

70%

reduction in overdue receivables

20%

faster invoice payment rate

65-80%

of customers set up affordable payment plans after using the solution

Contact us

"*" indicates required fields